Page Contents

Your DIY to will making

Thinking about what happens after you die is probably something you don’t want to dwell on, but taking an informed decision on what you want to do with your possessions and assets after your death is crucial. What can be better than creating a will to ensure your hard earned money and assets go in the right hands? If you think you cannot make your own will without a lawyer, you are wrong.

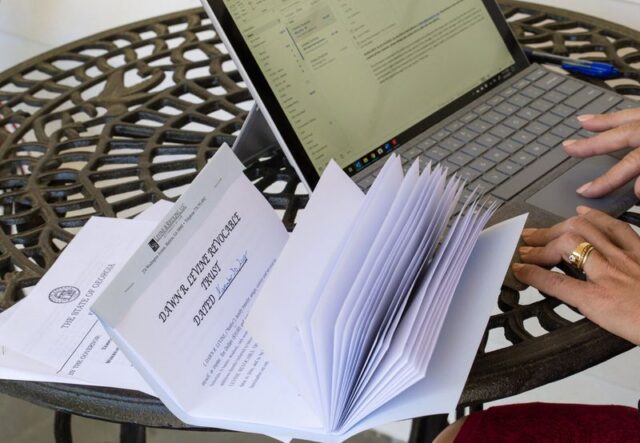

It’s quite easy to make your own will; it doesn’t have to be complicated at all. When do you need the attorney? There could be some situations where you might need legal help. For an instance, you own an estate and you want it to be given to a trust after you die. Another reason could be you own a property in a different county. In all these scenarios, having an attorney is useful.

However, if you are looking to create a simple will to cover your basics such as your investments, cash, property and so on, you can do it online without any fuss. Don’t worry, with the required digital signatures, a will that you create using templates online is just as legal as the conventional one created by a lawyer.

Some states in the US have their unique rules that you might want to check to be sure you don’t miss out on anything important. If you are using a software or online agent, all such guidelines are likely to be provided for your will. Let us look at some of the basic things you need to consider while doing it yourself.

How to create your own will without a lawyer?

An easy and simple way is to do it online and here are simple steps to create your DIY will using an online will template. Fill in all the required details and create it right away.

Step 1: Find an online will template or service provider

While the majority of the states in the US recognize handwritten wills as valid, you can even type it out on your laptop. There are various templates available online that can guide you in drafting your own will. If you want to avoid that, you can even use an online service provider such as onlinewillmakers.com to help you with the process.

Step 2: Create a list of your assets

Create a list of all your assets including real estate, cars, jewelry, bank accounts and so on. For your life insurance and retirement accounts, you don’t have to write who is going to get the money as they separately have all the details around the beneficiary. In addition, for all your investment accounts with transfer on death provision, include the beneficiary details directly in the accounts.

Step 3: Take time to decide who gets what

Take your own time and be as clear as you can in writing who receives what. Use their full names and do not forget to include a second beneficiary. For example if you wish to give all your hard cash to your son, instead of writing – my cash goes to my son, write his full name along with the complete address.

Step 4: Appoint a guardian

In case you have a minor or dependent child, it is important to name a guardian in case you are the last surviving parent or if the other parent is unfit to take the responsibility. Failing to do so would give the authority to the court to appoint someone.

Step 5: Include an executor

It is important to name an executor as this is the person who will take care of your property and distribute it as per your wish, pay your remaining debts and pending bills and also handle probate. If you don’t want one person to be the executor, you can include multiple names as well.

Step 6: Have a name for residuary beneficiary

Once the executor has done his job of distributing the assets and paying off the debts/bills, the residuary beneficiary will get whatever if left out in your system. Residuary beneficiary could be an individual or even a charity organization.

Step 7: Ask witness to sign your will

Once you have listed out everything possible, think of two people who can sign it as witnesses. These must be over 18 years of age and not the beneficiary in your will. Get the will signed by them. Some of the states even require the will to be notarized. Have your witnesses sign a self-proving affidavit to avoid getting it testified.

Step 8: Store the signed will in a safe place

Ensure you keep the signed will in a safe place and let the executor know about it. It is always good to review it once every 2-3 years.

Online will maker services

As mentioned previously, if you wish to include certain assets for which legal guidance is required, a good online will maker can offer you reasonably priced document creation. He can help you with all the document filling processes including a living will, power of attorney, health care derivatives and so on.

Evaluating the online will makers across categories, attorney access, service charges, inclusion and accessibility of relevant forms, and quality of guidance. Usually, the basic laws do not differ from state to state, but if there is any advice needed on advanced laws or complicated ones, these experts should be able to help you to draw up the will the professional way. They might use the latest automated technologies to create your will, they will include a real-time attorney to double check your documents.