The tax system has been complicated since its implementation. Furthermore, taxes have benefited a few, while many suffer from unbalanced tax legislation. However, with Iowa’s historic flat tax bill, they have managed to make some effective and substantial changes to the state’s tax situation—see more here.

The Iowa Flat Tax Bill was signed into law this year, and the news of what this bill would provide to Iowans has been far-reaching. While the law introduces some changes that will be implemented gradually, the idea is that these changes will help replenish the health of the state’s economy. Nonetheless, not everyone is excited about this historic bill.

Page Contents

What does the Iowa Flat Tax Bill entail?

The flat tax is supposed to drop the tax rate to 3.9% over four years. Thus, the changes will be implemented in phases so as not to overwhelm the economy too much too fast. This change will make Iowa number four among states with the lowest individual income tax rates. The flat tax rate should be fully implemented by the year 2026.

Taxes on retirement income will also be eliminated for retirees living in Iowa. This is important, as many retirees are prone to some heavy tax bills, making their fragile financial situation that much more difficult.

Taxes are also going to be lowered for corporations operating in the state. With all these taxes being cut, it is estimated that close to $2 billion less will be received by the state in tax revenue each year.

Who will benefit from this Flat Tax Bill?

The Iowa government did not waste time making sure this bill got passed through, and both the House and The Senate were excited about what this bill would mean for its citizens. However, there is some debate about who exactly this bill will benefit.

Of course, retirees will benefit from no longer having to pay income tax on their retirement income. This will help save them a lot of money, which retirees could use given that they survive on a fixed income.

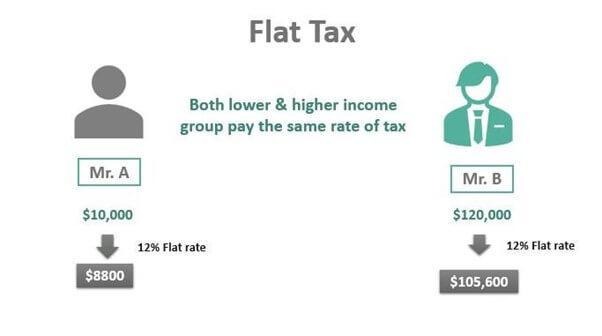

Simple math can also easily conclude that those with a higher income will benefit more from this flat tax.

- For example, 3.9% of $500,000 will amount to much more than 3.9% of $30,000.

The critics of the Iowa Flat Tax Bill

Not everyone is a big fan of what this bill will accomplish. Some political opponents, for example, do not believe this bill does enough to address the needs of the middle class and lower-income earners. Moreover, it is believed that the intentions of this bill are not as pure as they seem on the surface.

Democrats have said they believe the Iowa governor was looking to appease donors and corporations instead of the everyday citizens of Iowa. Democrats are also concerned about how these lower taxes will impact much-needed government services funded through taxes.

The potential long-term impact

While this historic tax bill’s potential long-term benefits and drawbacks won’t be seen for a few years, that has not stopped politicians from making some guesses as to what this bill might cause.

One of the biggest concerns that have been raised is that public services are going to suffer. Public and government programs such as education and mental health services are just two of the essential services that some are worried about diminishing.

The benefits and drawbacks of a Flat Tax

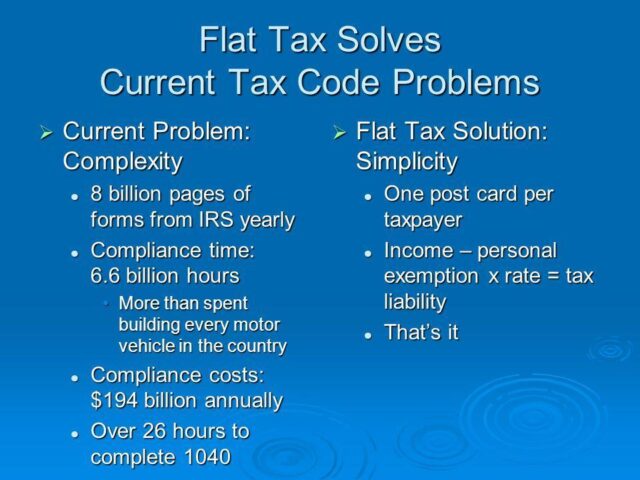

On the surface, having a flat tax rate that everybody pays seems like a fair way to tax people. However, when dissected more carefully, there are many benefits and drawbacks to implementing a flat tax.

At a low rate, a flat tax can help reduce the amount of tax a person has to pay. With the current tax structure, taxes are higher depending on the amount of money. If you do not have many ways to reduce the amount of taxes you have to pay based on your income, you could owe a lot in taxes.

Flat taxes that have been implemented in other countries have shown significant economic improvements. For example, Estonia is one country that has seen their country’s economy get stronger after implementing a flat tax.

- Estonia’s rate started at 26% but has since decreased to 20%. Their unemployment rate has also gone down significantly.

That all being said, other factors come into play that cannot be ignored when looking at countries with flat tax rates and their economic benefits. With the income situations in countries being so different from one another, there is no substantial proof that a flat tax in and of itself is good for economic growth.

One of the most obvious drawbacks of the flat tax is that, with such a vastly unequal distribution of wealth throughout the United States, the biggest beneficiaries of the flat tax are people who make a lot of money. Thus, citizens who make a middle class or lower-class level income are not going to see much change in their tax situation.

Taxes being cut to a dramatically low level can also reduce the services that tax money funds. With social and government services already grossly underfunded, any reduction in the amount of money they can work with to provide their services will be catastrophic.

The wealthy in Iowa benefit more

While this historic tax bill has been marketed to the entire population of Iowa as a massive benefit, it’ is clear that the people who will benefit the most from this flat tax are wealthy people and corporations. This population, albeit small, already benefits from the current tax structure.

Those opposed to flat taxes, such as the new Iowa flat tax, feel the wealthy should be picking up more of the tax burden for the country than those who make smaller incomes.

Wealthy income earners will not suffer much from increased taxes, but lower and middle-income earners could see a dramatic increase in their living standards when having to pay less tax.

Final thoughts

Tax bills are never going to be able to please everyone, but tax reform is needed within the United States to try and improve the economic situation for all. While there is no simple solution, any effort made to make living standards better for the citizens of the United States is worth noting.

The Iowa Flat Tax Bill has made waves, both within the state and outside of it. While some of the beneficiaries of this tax bill are worthy of tax breaks, there are questions about the true motives behind implementing this bill.

Most would agree that corporations do not need tax breaks as much as the middle class and lower class, but time will tell whether this strategy will benefit Iowa in the long term.